From Chaos to Clarity: How to Start Your Personal Budget Journey

Learn how to create a personal budget with simple steps, tools like Notion templates, and tips for managing expenses, savings, and financial goals.

26 lis 2024

Notion

5 min

"I don't understand where it all goes," Sarah muttered as she stared at her bank statement. Despite earning a decent salary, she scraped by at the end of every month. Unexpected expenses, impulsive online shopping, and those daily coffee runs seemed trivial individually, but together, they formed a black hole swallowing her hard-earned money.

One evening, after declining yet another invitation from friends because her budget was tight, Sarah decided enough was enough. She needed to take control of her finances, and she knew exactly where to start: creating a personal budget.

If you've ever felt like Sarah—wondering how your paycheck disappears so quickly—you're not alone. Starting a personal budget can seem daunting, but it's a transformative step toward financial freedom. Let's walk through the journey that helped Sarah turn her financial chaos into clarity and discover how you can do the same.

————————————————

Step 1: Acknowledge the Need for Change

The first step in Sarah's journey was recognizing that her current approach wasn't working. She felt stressed, unprepared for emergencies, and unable to enjoy life's pleasures without guilt.

Your Turn: Reflect on your financial habits. Are you frequently anxious about money? Do unexpected expenses derail your plans? Acknowledging the problem is the catalyst for change.

Step 2: Define Your Financial Goals

Sarah grabbed a notebook and jotted down what she wanted: an emergency fund, paying off her credit card debt, and saving for a dream trip to Japan.

Your Turn: Set clear, achievable goals. Whether it's eliminating debt, saving for a house, or building an emergency fund, knowing your objectives gives your budget purpose.

Step 3: Track Your Income and Expenses

For a full month, Sarah diligently recorded every expense—rent, utilities, groceries, even that $2 app purchase—using an expense tracker in Notion.

Your Turn: List all sources of income and track every expense, no matter how small. Use tools like The Money OS, spreadsheets, or a simple journal. This awareness is crucial.

Step 4: Categorize Your Spending

Sarah started simply by categorising her expenses into three categories: essentials (rent, utilities, groceries), non-essentials (dining out, entertainment), and savings/debt repayment, organizing them within her finance database.

Your Turn: Group your spending into categories that make sense for you. Common categories include housing, transportation, food, entertainment, and savings. Utilizing a Notion budget template can simplify this process, but you should use the tool you feel the most comfortable with.

Step 5: Analyse and Adjust

Seeing it all laid out, Sarah was shocked that she spent $200 a month on coffee alone. She decided to brew at home and divide that money toward her debt, updating her Notion personal budget accordingly. She knew she would return to her takeaway coffee, but it wasn't the right moment.

Your Turn: Identify areas where you can cut back. Minor adjustments can lead to significant savings over time. Reflect on these changes in your Notion money management system to stay on track.

Step 6: Choose a Budgeting Method

After some research, Sarah opted for the 50/30/20 rule: 50% of her income for needs, 30% for wants, and 20% for savings and debt repayment. She implemented this framework into her Notion monthly budget.

Your Turn: Select a budgeting framework that fits your lifestyle. Popular methods include:

Zero-Based Budgeting: Assigning every dollar a job until you have zero left.

Envelope System: Allocating cash to envelopes for different spending categories.

50/30/20 Rule: Balancing needs, wants, and savings.

Using a Notion budget template can help you integrate these methods seamlessly.

Step 7: Use Tools and Resources

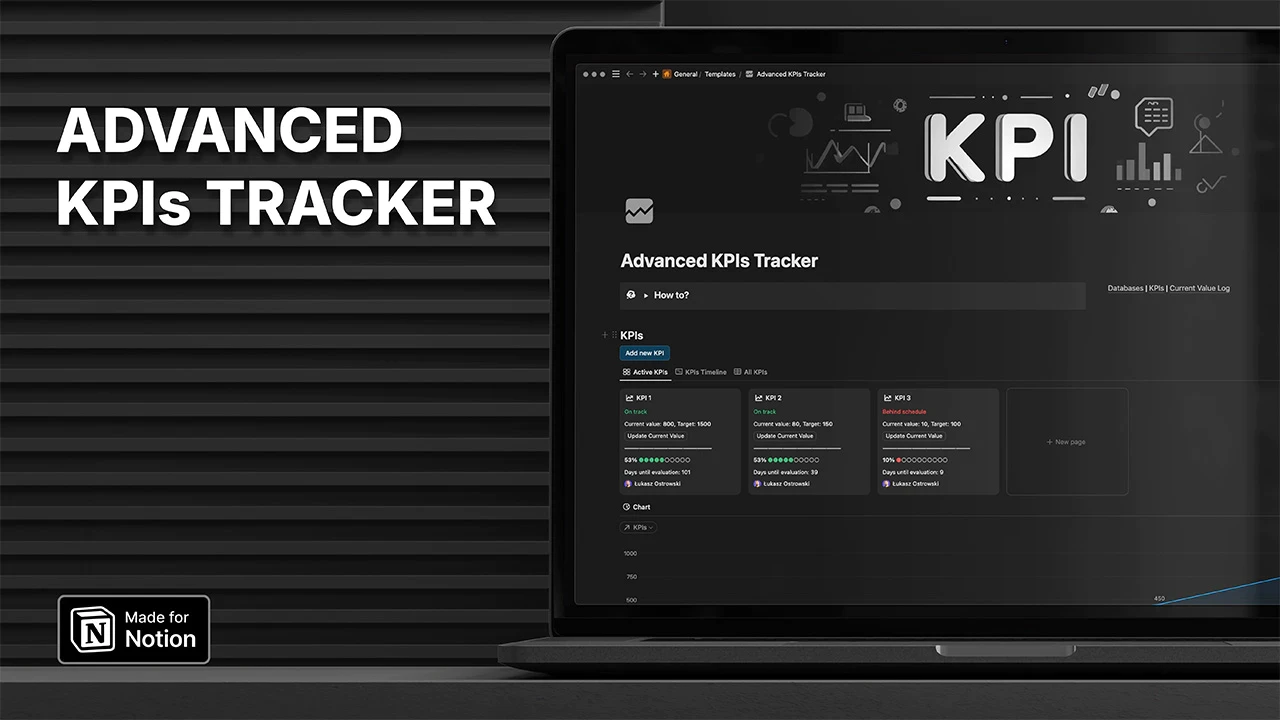

Sarah discovered that using Notion for money management made budgeting more engaging. She downloaded a Notion budget template and customized it to fit her needs, integrating an expense tracker and savings tracker in Notion. This gave her a comprehensive monthly budget dashboard that synced all her financial data in one place.

Your Turn: Leverage technology. Consider using platforms like a Notion finance tracker to create a personal budget that suits your lifestyle. With tools like the Notion finance database and various Notion budget templates, you can simplify the budgeting process and have all your financial information at your fingertips.

Step 8: Build an Emergency Fund

Determined to avoid future stress, Sarah began setting aside a small amount each month into a separate savings account, tracking her progress with a savings tracker in Notion.

Your Turn: Aim to save at least three to six months' worth of expenses. Start small; consistency is key. Use tools like a savings tracker to track your growth.

Step 9: Stay Accountable

Sarah shared her budgeting goals with her sister, who became her accountability partner. They checked in weekly, celebrating successes and discussing challenges, often reviewing her Notion monthly budget dashboard together.

Your Turn: Find someone to support you—be it a friend, family member, or financial advisor. Accountability increases your chances of sticking to your budget. Sharing your Notion finance tracker updates can make this process interactive.

Step 10: Review and Adjust Regularly

Understanding that life isn't static, Sarah revisited her budget monthly, making adjustments for upcoming events or changes in income. Her Notion monthly budget dashboard allowed her to see where she stood each month easily.

Your Turn: Review your budget regularly and adjust as needed to accommodate life's ebbs and flows. Tools like a monthly budget dashboard in Notion can help you stay on top of your finances.

————————————————

Epilogue

A couple of months later, Sarah felt a weight lift off her shoulders. She wasn't just surviving until the next paycheck—she was thriving. With an emergency fund growing and her debt shrinking, she even booked that trip to Japan, paid for entirely with savings. The journey was made smoother by utilizing a Notion budget template that organised her finances.

Starting a personal budget transformed Sarah's life, and it can do the same for you. It's not about restricting yourself but about making conscious choices that align with your goals. Tools like The Money OS solutions can make this journey more accessible.

So, are you ready to turn the page and start your own budgeting story with Notion?

————————————————

Embarking on a budgeting journey is empowering. Share your goals or tips in the comments below—your story might inspire someone else to take control of their finances! And if you have experience with Notion budget templates or finance trackers, I'd love to hear how they've helped you manage your money — use @OstrowskiLukasz on X.